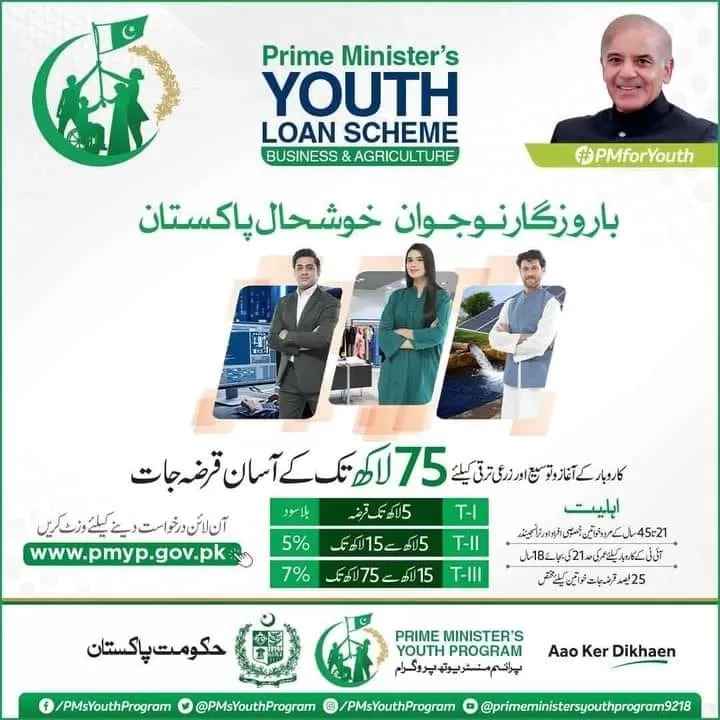

The Government of Pakistan has launched the Prime Minister Youth Business Loan Scheme to provide interest-free business assistance and education loans. The Prime Minister has decided to provide interest-free loans ranging from 5 lakhs to 75 lakhs to empower the youth in Pakistan.

The main objective of the Prime Minister Youth Loan is to provide employment opportunities for the youth. The scheme includes measures like interest-free loans, business support, and vocational training.

If you have completed your education or want to grow your business, the government can help you. From small-scale projects to large-scale entrepreneurial endeavors, the Prime Minister’s Youth Loan Scheme aims to promote economic growth and self-reliance among youth. So that all the youth of Pakistan have to stay in their own country and do business, as a result, our country will become more stable.

Prime Minister Youth Business Loan Scheme

Young people can start their new business through the Prime Minister Youth Business Loan Scheme, which was launched to support business start-ups. So that all young people who want to start their own business can get an initial interest-free loan from the government. But in the absence of resources, their dream cannot be fulfill.

To increase employment opportunities and eliminate unemployment within Pakistan, the PM Youth Loan has been launched for youth in business and agriculture. However, with this program, all Pakistani youths can apply online for loans.

Prime Minister Youth Business and Agriculture Loan Scheme gives more than 20 commercial, Islamic, and SME banks loans to the youth at low interest rates and with easy installments.

Prime Minister Loan Scheme

The prime objective of the Prime Minister Youth Loan Scheme is to improve Pakistan’s economy. The trend of youth will be towards business, you can start your grocery store and other businesses as soon as you apply for a loan. Both men and women can apply for this scheme.

Prime Minister Youth Loan Eligibility Criteria

Meet the following criteria, you can easily qualify for this scheme.

- National Identity Card

- All Pakistani citizens between the ages of 21 to 45 are eligible to apply.

- People with experience in any small or large business are eligible for this program.

- Only Pakistani citizens will be eligible for this scheme.

- Visit the official website to get more information.

See: Ehsaas Loan Program

PM Youth Loan Scheme Online Application

Prime Minister’s Youth Program online application by visiting the official website. Fill out the given online form and submit your application. However, to get this loan, you have to complete the application form with all original data.

Prime Minister Program For Youth Required Documents

- National Identity Card

- Bank account

- Educational degree

- Must have proof of business.

PM Youth Loan Tenure

You will pay the loan amount in full in three years, If you cannot pay on time, the interest will increase over time. The maximum you will have to repay the loan of up to 75 lakhs in 8 years.

Prime Minister Youth Loan Program Helpline Number

If you are facing any kind of problem, then you can contact the 051-9203585 number because it is the official helpline number.

See: Governor Sindh Loan Scheme

Conclusion

The Government of Pakistan continues to provide low-interest loans to all young Pakistani entrepreneurs. If you also want to apply for a loan, then you can apply for this loan with Punjab Bank. There is no deadline for application submission. Moreover, each applicant must pay a 200-rupee application fee.

How much can be borrowed through the PM Youth Loan Program?

Through the PM Youth Loan Scheme, you can get a loan of a minimum of 5 lakhs and a maximum of 75 lakhs.

How to Apply for the PM Youth Loan Scheme?

You can also submit an application online for the PM Youth Loan Scheme. Or you can also submit your application through Punjab Bank; both methods are valid.

Are only men eligible for this PM Youth scheme?

No! Both men and women are eligible for this program and can apply.

PM Youth Business Loan Scheme Last Date?

No such announcement has been made yet, but a large number of people are submitting applications to get the loan.