Akhuwat Loan

Akhuwat Loan is a non-profit organization established in 2001 based on the Islamic principle of Muwakhat or Unity. The goal of this non-profit organization is to provide interest free loans to those eligible poor people who want to start a new business. Apply and get a loan today. Without the fear of paying any interest on this loan, you can take this loan because the Akhuwat Foundation works on 100% teachings of Islam.

With the start of this month, the new registration for the Akhuwat Loan Scheme 2025 start by the officials. This time the Akhuwat Foundation is giving millions of Interest Free Loans. Hence, now you don’t need to get a loan from anyone at an interest rate. Because the Islamic and non-profit organization is here. All eligible Pakistani CNIC holders can get the loan. Whenever an eligible person gets an free loan and start a small business then the poverty level of the country will decrease as a result.

Akhuwat Loan Apply Online

You can apply online for interest free loan from the Akhuwat Loan Scheme online registration method. This loan scheme also gives loans to those who want to build their own house. Yes! Both loan types (for business and house) details, online application, required documents and related information is describe here in this article.

For online registration, you have to visit the Akhuwat Org Pk portal. From there you will get the loan form. Download the form and fill it according to your personal information. Once the form filled completely. Then you have to visit the Akhuwat office and submit the form there. Officials of Akhuwat Foundation will review your loan form and once the details are verified you will get the loan.

Note: There is also a second method to get a loan in which Akhuwat makes a group of applicants and provides loans to them.

Akhuwat Loan Required Documents

While applying for a loan. You have to submit the following required documents along with the Akhuwat Loan Form:

- Applicant CNIC Copy

- Guarantors CNIC Copy

- Applicant’s latest photo

- Utility (electricity & gas) bills copy

- Applicant’s Nikahnama or husband CNIC copy

Collect all these required documents and visit the nearest Akhuwat center in your area. You must have you gather at least 10 women with you from your colony who are also deserving and they want to get loans. Because this program provides a loan to the groups not to a single person.

Eligibility Criteria

Akhuwat Loan will be only given to those individuals who meet the following compulsory eligibility criteria:

- Applicant must have a NADRA CNIC

- Applicant must have the ability to run the business on its own

- Age of the applicant must be between 18 to 62 years to get a loan

- The character of the applicant should be good and supportive of everyone

- Currently, the applicant must have enough resources to bear home expenses

- There must not be a previous criminal record of the applicant in police record

- It is compulsory to provide at least two guarantors other than relatives to get the loan

- To get an Akhuwat loan your home must be near the office (center) of the foundation

Other Documents Required

As we have mention above, the loan will be given if you provides the reference of two guardians. That’s why, you must need additional following documents:

See: Ehsaas Program 14000 Online Check

Along with the names of the required documents, the objectives of those documents are mentioned above. So that applicants remain aware of why his/her documents have been gathered.

Process Of Loan Distribution

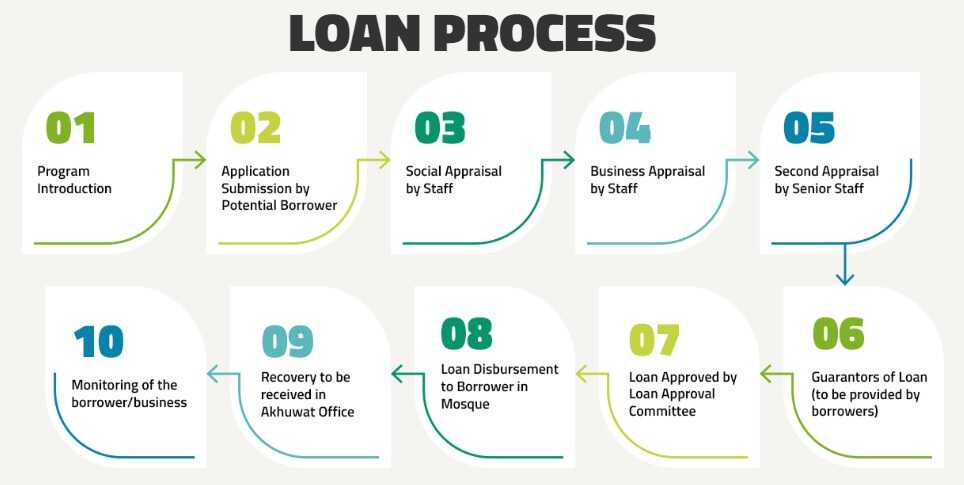

The Akhuwat Loan has 10 processing steps in which the loan is distribute among the needy and eligible persons. These steps include:

First of all the officials will introduce this loan program to all individuals. In second step, the application will be submit by the potential borrower. In the third step the staff will perform social appraisal. Fourth step contain business appraisal by staff. The fifth step makes the loan process half which includes second appraisal by the senior staff member of the Akhuwat loan provider

See: Ehsaas Program 12000 Online Check

The sixth step include to provide two valid guarantors by the loan borrower which guarantee that he/she will return the loan. In the seventh step the loan approval committee will approve the loan and in the eighth step the loan is finally distribute among all the borrowers in the mosque or the nearest Akhuwat center. Loan recovery is the part of ninth step and finally in the tenth step a special Akhuwat members committee visits the loan borrower and monitor his/her business.

Conclusion

It is easy for every single soul to get loan from Akhuwat Foundation in 2025 in Pakistan. You just need to visit the nearest center of Akhuwat Foundation and ask them to guide you, how to get loan for business or to build a house. They will guide you and give you loan.

3 thoughts on “Akhuwat Loan Scheme 2025 Full Details”

Comments are closed.