Punjab Rozgar Scheme

The Government of Pakistan has introduced the Punjab Rozgar Scheme to stabilize the startups and existing businesses. Online registration is start. According to this scheme, you can apply for a loan from one lakh to one crore at just a 4% & 5% markup. The total estimated budget of this scheme is thirty billion rupees. Till this time, people have received loans up to ten crore rupees from this scheme.

The main objective of the Punjab Rozgar Scheme is to provide resources to start your own business. This scheme aims to provide financial loans to exciting business owners. People who want to start a business can get a loan from the government of Pakistan under the roof of the BOP Rozgar Loan Scheme on easy terms.

The loan of this scheme will be given only to the people living in the province of Punjab. To get money, you have to apply by going to the nearest branch of the Bank of Punjab. The objective of the Punjab Rozgar scheme is to eliminate unemployment in the province of Punjab and provide economic independence to the youth. Under this scheme, deserving individuals will be offered interest-free or low-interest loans to start their businesses or to boost their existing businesses.

Loan Scheme Key Features

The Punjab government provides conditional cash loans to the young generation for financial support through government banks to expand their business or start a new one. There are not so many conditions that have been implemented by the government to get this loan. Hence, a simple person cannot fulfill the conditions and avail a business loan.

The government of Punjab started this scheme with the Bank of Punjab. For the Punjab Bank loan application, you can visit the official website of Punjab Bank. For more information, you can also visit the Punjab Rozgar Scheme’s official website.

| Particulars | Key Features |

| Loan Amount | Rs. 100,000/- to Rs. 10,000,000 |

| Loan Category | Clean & Secured |

| Type Of Loan | Term Business Loan |

| Applicant Age | 20 to 50 Years |

| Applicant Gender | Male/Female/Transgender |

| Residency | Punjab, Pakistan |

| Interest Rate | 4% and 5% |

| Loan Tenure | 2 to 5 years |

Punjab Rozgar Scheme Eligibility Criteria

To get money from the Punjab Rozgar Scheme, you must have to fulfill the following criteria.

- Applicant’s age must be between 18 to 50 years.

- Applicant must be a Pakistani and a resident of Punjab.

- Both men and women are eligible for this loan scheme.

- University graduate diploma holder with skill-related training.

- Have a skill or business knowledge with at least 5 years of experience.

Total Loan Amount For the Scheme

According to officials, the government will provide a clean loan of Rs. 100,000/- to Rs. 1,000,000 to each individual for the business. This loan amount can be increased (secured loan) according to the nature of the business, Rs. 1,000,000 to Rs. 10,000,000 respectively. The government has set 2 to 5 years, including 6 6-month grace period for the loan tenure. Moreover, the Bank of Punjab is the main commercial bank for this program loan. To register in the Loan Scheme, apply today from the official portal.

Punjab Rozgar Scheme Online Apply 2025

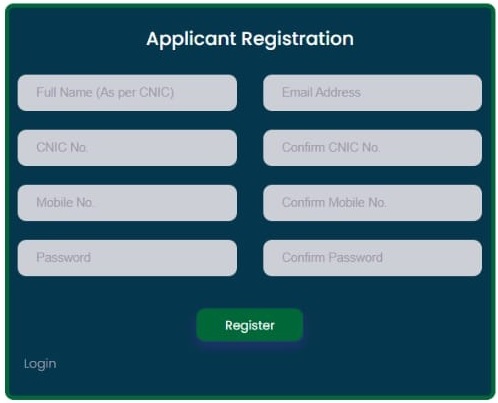

If you want to apply online for the Bank of Punjab Rozgar Scheme loan. Then follow the given process:

- Visit the official web portal at rozgar.psic.punjab.gov.pk

- Click on the applicant signup button and create a new account to register for the BOP Rozgar Scheme.

- Fill out the Create New Account form with your full name, CNIC number, email, contact number, address, and password.

- After providing all your information, click on the Register button.

- Now you will receive an OTP on your provided phone number.

- Provide the OTP and create your account on the official portal.

- After creating an account, sign in to your account using your CNIC and password.

- When you sign in, apply to the Punjab Rozgar Scheme by downloading the official form.

- You can also visit the nearest Bank of Punjab branch to apply for a business loan in the Rozgar Loan Program.

Required Documents For the Punjab Rozgar Scheme

To apply online for the Punjab Rozgar Scheme, you must have the following documents.

- National Identity Card.

- Passport-size 4 photographs.

- A graduation degree or any diploma certificate.

- Business Experience Certificate.

- Proof of personal business.

See: Ehsaas Loan Program

What is the Loan Security?

As you know, the bank always demands security before providing loans to any individual. Hence, this scheme also demands the following security from the applicant:

- Guarantee of Borrower

- Guarantee of Third Party

- OR Guarantee of a Government Employee of BPS-10 or above

Punjab Rozgar Scheme Last Date

The last date to apply for the Punjab Rozgar Scheme is 1st September 2024 to 25th October 2024. Complete your registration today and visit the nearest Bank of Punjab branch to get your application submitted before the last date. However, the application after this date will not be accepted.

See: Akhuwat Loan Scheme

Conclusion

Punjab Rogar Scheme has become a ray of hope for the young generation which is facing unemployment. Yes! Now you don’t need to find a new job. Start your own new business and become boss. This scheme is very important for those young people who want to start their own business or want to increase their business further. Punjab Rozgar Loan Program is providing loans of millions of rupees only to educated and skilled male, female, and transgender youth. This scheme will open a gateway to new employment opportunities.

What is the Punjab Rozgar Scheme?

Punjab Rozgar Scheme is a youth loan that will make youth self-sufficient to start new businesses or to widen their old businesses at low interest rates.

How much loan Punjab Rozgar Scheme Provide?

This loan scheme provides Clean and Secured loans having the following limits.

- Clean: Rs. 100,000/- to Rs. 1,000,000

- Secured: Above Rs.1,000,000 up to Rs. 10,000,000

Who is eligible for the Punjab Rozgar Scheme?

Males, females, and transgender of 20 to 50 years of age having a graduation degree are eligible for this loan scheme.

What is the processing fee for this scheme?

Applicant must pay a non-refundable Rs. 2,000/- processing fee for this loan scheme.